Those BlackBerry results for the quarter to the end of November. Terrible? Yes. A fall in revenues quarter-on-quarter, and a whopping operating and net loss. The title of this post is, yes, a reference to the old joke – the guy with a spade who is working his way through a mountain of horse crap. Someone comes up and asks him what he’s doing. “With this much crap, there’s gotta be a horse in here somewhere,” the man replies. In the same way, I’m fairly sure there’s a profitable business somewhere inside BlackBerry. The trouble is finding it. John Chen has done an impressive job since he came on board just over a year ago. But he hasn’t found the profit either (we’ll get to the little financial twiddling that let Chen claim a profit later). I wrote about how much trouble BlackBerry is in after its last quarter. How are things three months on? There’s obviously a profitable business hidden in there: it provides high-security keyboard-based smartphones to governments and businesses which put a premium on connectivity and security. The trouble is extricating that from the loss-making consumer side, and the high costs of making smartphones at far less than scale, and how to fight off the competition to be in charge of mobile device management (MDM) at big companies and in governments. So, let’s start digging. (Click on images for a large-sized version.) Bad headlines The headline numbers are bad. Revenue fell 33.5% year-on-year to $793m, and 14% sequentially.

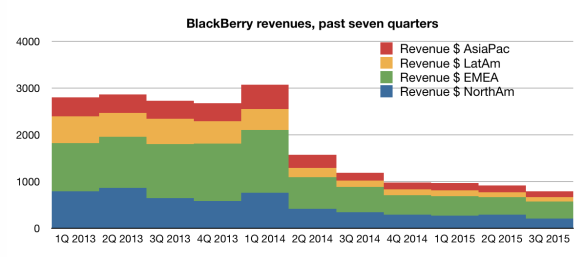

GEOGRAPHIC

The graph shows how things aren’t working for the company. EMEA (Europe, Middle East and Africa) has long been the largest segment, principally because of subscribers in South Africa and the rest of Africa; the UK used to be a stronghold too, but that’s faded. Asia-Pacific hasn’t looked too rosy either for the past few quarters; but those are consumer areas, and that side of BlackBerry’s business just isn’t happening.

HARDWARE

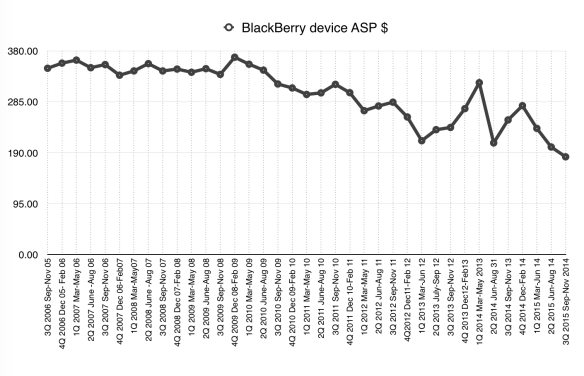

BlackBerry shipped 2m units but “sell-through” (to end users) was 1.9m, which suggests there’s no surplus in the channel now; it’s cleaned out. Does that mean there are no more BB7 devices like the Bold to buy? Again, unclear. But the ASP (average selling price) cratered:

Note that the ASP has halved from the December 2008 quarter, six years ago. Chen expects that to pick up now. Yet BlackBerry is struggling to fulfil even quite small demands, it seems. Chen is very vague about how many Passports were shipped (and paid for) in Q3 (transcript from Seeking Alpha)

Going forward, because of the new products, we expect the ASP to start picking back up again. We’re able to fulfil about 200,000 Passport orders that was preordered at the time we announced it, while reducing the manufacturing lead times to roughly now between four to six weeks. However, because we have sold our stock out a number of times in the quarter waiting for the fulfilment, we were only able to fulfil order backlog of Q3 by December 12. So that was clearly already into Q4. And I also want to remind everybody that our revenue of these devices are all recognised on a sell-through basis. So not every one of those units, in fact most of those units revenue are not recognised in Q3. And we obviously will recognise as they lead [ph] up in throughout the next few quarters.

Data point: 61% of Passport sales were in the US. See how much that helped revenues? Oh, sure, it didn’t. Revenues fell in North America. Also, Chen said that the hardware side could be profitable with sales of 10m units per (fiscal) year. It’s some way from that: 5.7m shipped after three quarters of the fiscal year (7m in the past four quarters); or 6.8m “sell-in” (to customers) in three quarters – and the magic 10.2m of sell-in over the past four quarters.

SERVICES

BlackBerry has made lots of profit from services. But it needs to make revenues from services for that to work. The Service Activation Fee (SAF) is what it gets from people who activate BB7 phones. And it’s declining: SAF revenues were down 13% sequentially, and will fall by about 15% in the next quarter according to the finance director. Looking at BlackBerry’s service revenues, those fell from $424m to $364.8m – which is a 13% fall. So that suggests that most of its service revenues are from SAF. That makes sense, looking at how the service revenues track the numbers of subscribers. The correlation between published subscriber figures and service revenues is really strong:

Service revenues and subscriber numbers are closely linked – BlackBerry used to get more money per subscriber than it does now.

The linking lines show the progression of the link between revenue and subscribers; notice how it goes below the correlation line to begin with (more money for fewer subscribers) and then goes above the line, and starts heading backwards (less money for the same number of subscribers). So whereas in the June-August 2010 quarter there were 50m subscribers generating $785m in revenue, for the March-June 2014 quarter, when there were 50m subscribers, they only generated $519m in revenue. And that’s going to continue to decline; on the 15% decline forecast by Chen, that means a $310m service revenue announced in March, covering the current quarter (to the end of February).

SUBSCRIBERS

For some time the best questions in the BlackBerry analyst call have come from Ehud Gelblum at Citi, and he didn’t disappoint. “Is there a subscriber number update that we can hang our hat on?” he asked Chen. Answer: “No, not right now.” We can do some calculating about subscriber numbers, though. There’s a figure of “service revenue per subscriber account” that you can work out from the published number of subscribers and the service revenues. To get to the drop in service revenues, there are three choices: • subscriber numbers stayed the same, but per-subscriber payments fell • subscriber numbers fell, but per-subscriber payments stayed the same • both subscriber numbers and per-subscriber payments fell. If it was the first, wouldn’t you expect Chen to have spoken up and spun it a bit? He didn’t. If it were the second, wouldn’t you expect him to spin it a bit? He didn’t. There’s a clue, though. Here’s Chen talking about the problem of going from BB7 to BB10:

I’m not go to be providing you the margin of the Classic but it is a positive margin and revenue of course is in the $400 plus. But then I lose $3 to $5 a month [in service fees] when that conversion happens. Sometime over the lifetime of this will cross over.

At $3 per month in service revenues, $364.78m suggests about 40m subscribers. If we model about 5m fewer subscribers per quarter over the past four or five quarters, we also get a consistent fall in per-account subscription.

Service revenue per subscriber account is constantly falling as consumers, carriers and businesses move away from the Service Activation Fee (SAF).

And according to Richard Yersh, about 80% of those subscribers are business users – so that’s 32m business users and 8m consumers on BB7. On the upside, with 6.9m business licences (pretty much all on free tryout) for its EZPass BES12 server, that does mean lots of potential clients. If – big if – it can get them to sign up for its services. The other problem about falling subscriber numbers is that it gives you fewer people to sell new handsets to. On a basis of a two-year refresh cycle, the further you fall below 40m, the lower the refresh. Over the past seven quarters, the sell-through (to end users) has been 24.6m – average 3.5m per quarter – which would be 28m per two years. Trouble is, the sell-through is falling; the latest is the smallest recorded. Why should things improve?

PROFIT?

Still, it made a profit, right? CFO James Yersh:

In the quarter we also turned in a non-GAAP net profit of $6 million or $0.01 per share. These results were largely attributable to disciplined management of margins and expenses.

“Non-GAAP” means “not using official measurements”. (“GAAP” is “Generally Accepted Accounting Principles”.) I don’t mind companies leaving out exceptionals – one-off payments for laying off staff or closing factories, say. The reasons here are trickier: GAAP operating expenses included $150m of revaluation of its $1bn of convertible debt, the value of which increased. It’s a non-cash charge, and doesn’t affect anything about how the business is actually run. Just as a flashback, the reason why BlackBerry is carrying a debenture debt is because it decided to go for a bailout after a buyout effort failed. The debenture raised $1bn at 6%, giving debenture holders the right to convert the debt into $10 shares in November 2020. The debentures have to be marked-to-market – that is, valued – because they’re a continuing obligation: they’re a risk to the company, because convertible debentures can be a risk to a company through short-selling. But even if we allow the non-GAAP profit of $6m, we have to ask what BlackBerry has ahead of it. Let’s recap: • it’s struggling to fulfil hardware orders, but has cleared out a lot of BB7 inventory, so now has to try to sell lots of handsets, which will be made for it by Foxconn • service revenues are falling • subscriber numbers are falling • it now has to convert business users who had the free EZPass deal to actually pay money, rather than going with a rival for less Actually, a forecast that looks about right to me comes from one of the (many) BlackBerry analysts on Seeking Alpha, who sets out what it will take for the company to achieve profitability in its next financial year: • hardware sales of 13m over the fiscal year (my comment: possible, but it shows no signs of coming close this fiscal year) • service revenues as a result of those hardware sales of $1.27bn for the year (my comment: might just be achievable, at $300m per quarter, which is where it’s heading). There’s a newer article by the same author, who seems pretty sensible. Recommended. BlackBerry used to straddle the smartphone world; now it has become a curio, one with a niche business that it has to turn into profit as the consumer side of its business subsides. But there must be a horse in there somewhere, right?